Loading

Get Irs 1040-nr - Schedule Oi 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040-NR - Schedule OI online

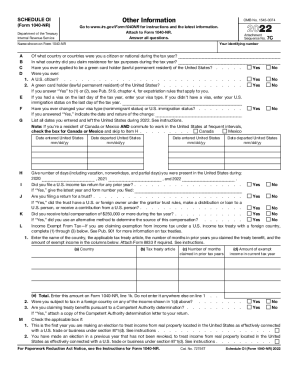

Filling out the IRS 1040-NR - Schedule OI online is a crucial step for non-resident individuals reporting their income in the United States. This guide provides clear and detailed instructions to assist you in completing the form accurately and efficiently.

Follow the steps to fill out the IRS 1040-NR - Schedule OI online

- Click ‘Get Form’ button to obtain the 1040-NR - Schedule OI form and view it in an online editor.

- Enter your identifying number in the designated field. This number is essential for linking your form to your tax records.

- Provide your name as shown on Form 1040-NR, ensuring accuracy for proper identification.

- Indicate the country or countries you were a citizen or national of during the tax year.

- State the country where you claimed residency for tax purposes during the tax year.

- Answer whether you have ever applied to become a green card holder in the United States.

- Respond to the questions regarding prior U.S. citizenship or green card status to ensure compliance with expatriation rules.

- If applicable, enter your visa type or U.S. immigration status as of the last day of the tax year. Provide information about any changes to your visa.

- List the dates you entered and left the United States throughout 2022.

- Specify the total number of days you were present in the United States for 2020, 2021, and 2022.

- Indicate if you filed a U.S. income tax return for any previous year and provide relevant details.

- Answer questions regarding any trusts involved in your tax return.

- Confirm if your total compensation during the tax year was $250,000 or more and if alternative methods were used for income source determination.

- If claiming exemption from income tax under a treaty, fill in the required details about the treaty and exempt income.

- Finally, review all entered information for accuracy and completeness, then save changes, download, print, or share the form as needed.

Begin filling out your IRS 1040-NR - Schedule OI online today!

U.S. nonresident aliens filing Form 1040NR cannot use the standard deduction nor all the itemized deductions afforded to U.S. resident aliens, nor can they file jointly if married.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.