Loading

Get Irs 4835 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4835 online

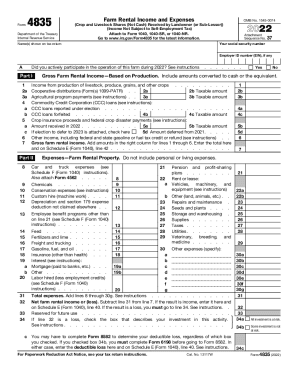

Filling out the IRS 4835 form can seem complex, but with a clear understanding of its components, you can navigate the process more easily. This guide provides step-by-step instructions for completing the form accurately and efficiently.

Follow the steps to successfully complete the IRS 4835 form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your social security number and the name(s) shown on your tax return in the designated fields at the top of the form.

- Provide your Employer ID number (EIN), if applicable, in the corresponding field.

- Indicate whether you actively participated in the operation of this farm during the tax year by checking 'Yes' or 'No'.

- In Part I, report your gross farm rental income based on production. Fill in amounts for income received from livestock, produce, grains, and other crops.

- Complete the detailed income sections, including cooperative distributions, agricultural program payments, Commodity Credit Corporation loans, and crop insurance proceeds as applicable.

- Proceed to Part II to report your farm rental expenses. Enter the total expenses for categories such as chemicals, depreciation, labor hired, and more.

- Calculate your total expenses by adding the amounts from lines 8 through 30g and enter the total on the designated line.

- Determine your net farm rental income or loss by subtracting total expenses from total income. Enter the result on the appropriate line.

- If your result is a loss, check the appropriate box indicating your investment at risk, and complete any necessary additional forms as instructed.

- Once all sections are filled, review your entries for accuracy, then save your form. You may choose to download, print, or share it as needed.

Begin filling out your IRS 4835 form online today to ensure accurate filing and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065. Your farming activity may subject you to state and local taxes and other require- ments such as business licenses and fees.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.