Loading

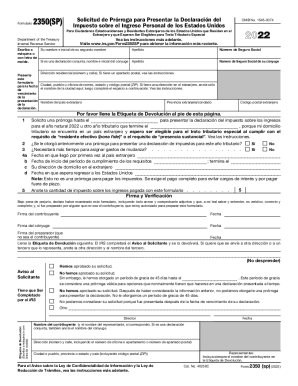

Get Irs 2350(sp) 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2350(SP) online

The IRS 2350(SP) form is a vital document for individuals seeking an extension to file their U.S. income tax return while living abroad. This guide provides step-by-step instructions on how to complete the form online efficiently.

Follow the steps to fill out the IRS 2350(SP) form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and initials in the designated field, along with your last name and Social Security Number.

- If filing jointly, provide your spouse's name, initials, last name, and their Social Security Number.

- Complete your residential address. If you have a P.O. box, refer to the instructions regarding this.

- Indicate whether you are requesting an extension until a specific date for filing your income tax return for the year ending.

- Answer the questions about previous extensions and whether you need more time for moving expense assignments.

- Provide the date of your arrival in the foreign country.

- Fill in the start and end dates for the period during which you are required to meet the bona fide resident or substantial presence test.

- Enter your physical address in the foreign country and the date you expect to return to the United States.

- Review your entries carefully for accuracy and completeness.

- Finalize your form by signing and dating it in the designated areas, ensuring all required signatures are included.

- Complete the return label at the bottom and save the form. You may download, print, or share the completed document as needed.

Ensure you complete and submit your documents online to maintain accurate records and avoid delays.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.