Loading

Get Irs 56-f 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 56-F online

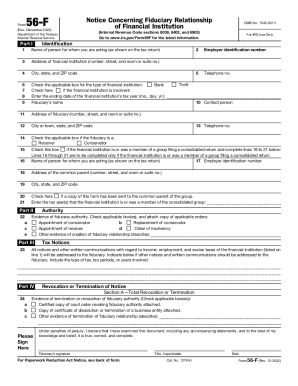

Filling out the IRS 56-F form is essential for notifying the IRS of a fiduciary relationship with a financial institution. This comprehensive guide provides step-by-step instructions for users, ensuring clarity and ease while completing this important document online.

Follow the steps to fill out the IRS 56-F online.

- Press the ‘Get Form’ button to access the IRS 56-F form and open it in your chosen online editor.

- In Part I, 'Identification', start by entering the name of the person for whom you are acting (line 1). This should match the name shown on their tax return.

- Move on to Part II, 'Authority', where you will check the applicable boxes to indicate your fiduciary authority and attach the relevant orders.

- In Part IV, 'Revocation or Termination of Notice', complete this section if you are revoking or terminating prior notices regarding fiduciary relationships.

- After filling out the form, save your changes, and choose to download, print, or share the form as needed.

Complete your IRS 56-F form online today for efficient filing.

More from H&R Block. An individual or entity that is willing to accept fiduciary responsibility for tax matters must file an IRS Form 56, Notice Concerning Fiduciary Relationship to be able to act as the taxpayer with the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.