Loading

Get Nc B-c-710 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC B-C-710 online

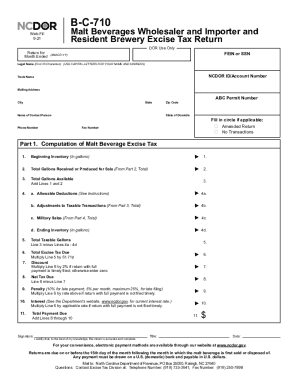

This guide provides you with a clear and supportive approach to filling out the NC B-C-710 form online. By following the detailed instructions outlined below, you will ensure that your excise tax return is completed accurately and efficiently.

Follow the steps to fill out the NC B-C-710 form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) in the designated field. This is necessary for identifying your business for tax purposes.

- Proceed to Part 1, where you will compute the malt beverage excise tax. Start by recording your beginning inventory in gallons.

- If applicable, calculate any discount for timely filing and subtract this from the total excise tax to find the net tax due.

- Once you have completed the form, you can save your changes, download, print, or share it as needed.

Complete your NC B-C-710 form online to ensure accurate tax reporting.

The current North Carolina excise tax stamps are $1.00 per $500.00 or fractional part of the value of the property conveyed. For deeds recorded prior to August 1991, the excise tax was $1.00 per thousand.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.