Loading

Get Irs 8960 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8960 online

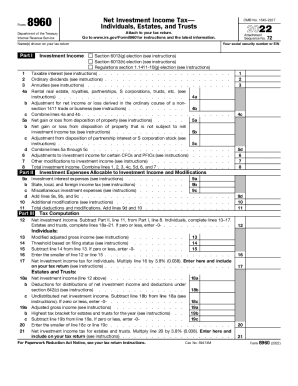

Filling out the IRS 8960 form is an important step for individuals, estates, and trusts who need to report net investment income tax. This guide will walk you through each section of the form, ensuring you understand what information is required and how to complete it accurately.

Follow the steps to effectively complete the IRS 8960 online.

- Press the ‘Get Form’ button to access the IRS 8960 form and display it in your preferred document editor.

- Enter your social security number or Employer Identification Number (EIN) in the designated field at the top of the form.

- Fill in your name and the names of any other individuals shown on your tax return as prompted.

- Proceed to Part I, where you'll document your investment income. For each type of income listed (taxable interest, ordinary dividends, annuities, etc.), enter the appropriate amounts based on your financial records.

- For line 4a, report your income from rental real estate and related sources. Use line 4b for any adjustments related to a non-section 1411 trade or business. Combine these figures for line 4c.

- In lines 5a to 5d, document any net gains or losses from property dispositions, ensuring to follow the instructions provided for calculations and adjustments.

- Complete lines 6 to 8 by making any additional adjustments to your investment income as instructed and calculating the total investment income.

- Moving to Part II, detail any investment expense deductions in lines 9a to 10. Ensure you aggregate and report all applicable expenses accurately.

- Calculate the total deductions and modifications required in Part II by adding the amounts from the previous lines.

- In Part III, determine your net investment income by subtracting total deductions from total investment income as indicated.

- For individuals, complete lines 13 to 17, which involve calculating modified adjusted gross income and determining the net investment income tax.

- Estates and trusts should complete lines 18a to 21, reporting net investment income and deductions as necessary, concluding with the tax calculation.

- Once all sections are filled out correctly, save your changes, and prepare to download or print the completed form for submission with your tax return.

Complete your IRS 8960 form online today to ensure compliance with net investment income tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The net investment income tax is a 3.8% surtax on a portion of your modified adjusted gross income (MAGI) over certain thresholds....Do I Need to Pay the Net Investment Income Tax? Filing StatusIncome ThresholdSingle or head of household$200,000Married filing jointly$250,0002 more rows • Jan 5, 2023

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.