Loading

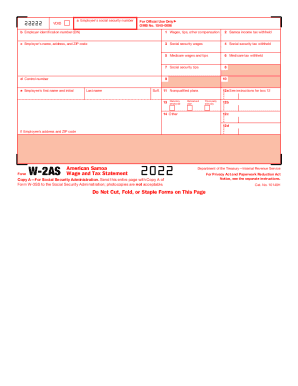

Get Irs W-2as 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-2AS online

Filling out the IRS W-2AS, the American Samoa Wage and Tax Statement, is an essential task for employers operating in American Samoa. This guide provides clear instructions to navigate the form's components effectively and ensure accurate reporting.

Follow the steps to complete the IRS W-2AS online.

- Click the ‘Get Form’ button to access the IRS W-2AS form and open it in your editor.

- In the first section, enter the employee's social security number. Ensure this information is accurate as it is crucial for tax reporting.

- Fill in the employer identification number (EIN) in the designated field. Use your official EIN to avoid discrepancies.

- Complete the employer's name, address, and ZIP code. This information identifies your business for the state and federal tax agencies.

- Record the wages, tips, and other compensation provided to the employee in box 1. This amount must reflect all forms of compensation.

- Indicate any Samoa income taxes withheld in box 2 to ensure proper tax calculations for the employee.

- Fill in the total social security wages in box 3, ensuring that this amount corresponds to the wages reported in box 1.

- Document the social security tax withheld in box 4. This amount is essential for both the employee’s records and future calculations.

- Enter the Medicare wages and tips in box 5, which contribute to the employee's Medicare benefits.

- Account for the Medicare tax withheld in box 6, ensuring this matches the withheld amount from the employee’s compensation.

- If applicable, report any social security tips in box 7. This is particularly relevant for employees in service industries.

- Fill in any additional codes or amounts in boxes 11 through 14 as instructed, ensuring accurate reporting of retirement contributions or other benefits.

- Review the completed form for accuracy. Once all information is verified, you can save, download, print, or share the form as needed.

Start filling out your IRS W-2AS online today to ensure timely and accurate submission.

Form W-2. Employers must complete, file electronically or by mail with the Social Security Administration (SSA), and furnish to their employees Form W-2, Wage and Tax StatementPDF showing the wages paid and taxes withheld for the year for each employee.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.