Loading

Get Ny Dtf Cms-1-mn 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CMS-1-MN online

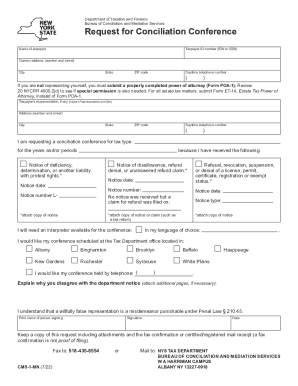

Filling out the NY DTF CMS-1-MN form can be a straightforward process when approached step by step. This guide will provide you with clear instructions to help you complete the form accurately while ensuring your needs are met throughout the process.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Begin by filling out the taxpayer information section. You will need to enter your name, taxpayer ID number (either your EIN or SSN), current address including number and street, city, state, and ZIP code.

- Next, provide your daytime telephone number to ensure the Tax Department can reach you if necessary.

- If you are not representing yourself, include the name of your representative and their firm details. Make sure to provide their address and daytime phone number as well.

- Indicate the tax type for which you are requesting the conciliation conference, along with the relevant years or periods. Attach any notices you have received regarding this matter.

- If applicable, indicate whether you will require an interpreter and specify your preferred language.

- Select the Tax Department office location where you would like your conference scheduled or indicate if you prefer to hold the conference by telephone.

- Provide an explanation for why you disagree with the department's notice. Be detailed, and you may attach additional pages if needed.

- Finally, print your name, sign the form, and provide the date of signing.

- Make sure to keep a copy of your request, including attachments, and the fax confirmation or certified/registered mail receipt. You can either fax your completed form to 518-435-8554 or mail it to the address listed on page one.

Start filling out your forms online today to ensure your voice is heard in your conciliation conference.

A local tax is an assessment by a state, county, or municipality to fund public services ranging from education to garbage collection and sewer maintenance. Local taxes come in many forms, from property taxes and payroll taxes to sales taxes and licensing fees. They can vary widely from one jurisdiction to the next.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.