Loading

Get Ny Dtf Rp-425-b 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF RP-425-B online

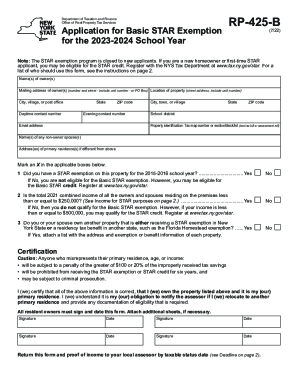

The NY DTF RP-425-B form is essential for homeowners seeking to apply for the Basic STAR exemption for the 2023-2024 school year. This guide provides a straightforward, step-by-step approach to assist users in completing this form online accurately and efficiently.

Follow the steps to complete the NY DTF RP-425-B form online.

- Press the ‘Get Form’ button to access the form and open it within your preferred online document editor.

- Enter the name(s) of the owner(s) in the designated section. Ensure that all co-owners are listed accurately.

- Provide the mailing address of the owner(s), including the number, street, unit number, or PO Box.

- Fill in the location of the property, including the street address, city, town, or village, and ZIP code.

- Include the daytime and evening contact numbers, along with an email address for communication, ensuring all details are current.

- Indicate the school district in which the property is located.

- Supply the property identification number (tax map number or section/block/lot), which can be found on your tax bill or assessment roll.

- List the name(s) of any non-owner spouse(s) if applicable, alongside their primary residence addresses if they differ from the one provided.

- Respond to the eligibility questions by marking an 'X' in the appropriate boxes. Be aware of the implications of your answers regarding eligibility for the Basic STAR exemption.

- Complete the certification section by signing and dating the form. All resident owners must sign — you may include additional sheets if necessary.

- Submit the completed form along with proof of income to your local assessor before the taxable status date. You can save your changes, download, print, or share the form as needed.

Start filling out the NY DTF RP-425-B online today to ensure you meet all necessary requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

STAR helps lower the property taxes for eligible homeowners who live in New York State. If you apply and are eligible, you'll get a STAR credit check by mail every year to use towards your property taxes.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.