Loading

Get Irs 941-ss 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941-SS online

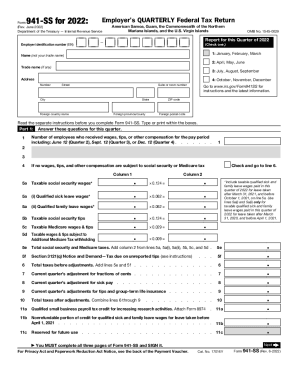

The IRS Form 941-SS is utilized for reporting employment taxes by employers in U.S. territories. This guide provides a step-by-step approach to assist users in accurately completing and submitting this form online, ensuring compliance with federal tax obligations.

Follow the steps to complete the IRS 941-SS online

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the reporting quarter by checking the appropriate box for the month range—January to March, April to June, July to September, or October to December.

- Enter your employer identification number (EIN) in the designated field.

- Input your name (not your trade name) and your trade name (if applicable) in the corresponding fields.

- Complete your address, including street number, suite or room number, city, state, and ZIP code.

- Answer the questions in Part 1 concerning the number of employees who received wages or tips during the specified pay periods.

- Fill in the taxable social security wages, Medicare wages, tips, and any other compensation in the specified lines.

- Calculate total taxes before adjustments by adding the appropriate lines.

- Check for any current quarter adjustments and fill them in appropriately.

- Compute your total taxes after adjustments and record this in the appropriate field.

- Provide information regarding deposits and overpayments in Part 3.

- Complete Part 4 by providing information on your third-party designee if applicable.

- Sign and date the form, ensuring that all three pages are completed before submission.

- Save changes, download, print, or share the completed form as needed.

Complete your IRS 941-SS form online today to meet your tax obligations efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Call 800-829-3676.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.