Loading

Get Irs 990 - Schedule H 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule H online

This guide provides comprehensive, user-friendly instructions for completing the IRS 990 - Schedule H online. Designed for users with varying levels of knowledge, this guide aims to ensure accurate and efficient completion of the form.

Follow the steps to complete the form seamlessly.

- Click ‘Get Form’ button to obtain the IRS 990 - Schedule H and open it in your preferred digital environment.

- Enter the name of the organization and its employer identification number at the top of the form.

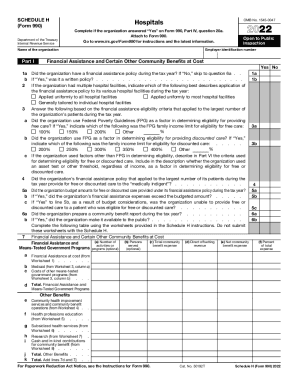

- In Part I, respond to the questions about the financial assistance policy. Specifically, indicate if there was a policy, whether it was written, and the application of the policy across hospital facilities.

- Complete questions about eligibility criteria for financial assistance, detailing the use of Federal Poverty Guidelines (FPG) by indicating family income limits for both free and discounted care.

- In Part II, provide information about the number of community building activities conducted during the tax year and their associated expenses.

- Address bad debt, Medicare, and collection practices in Part III, explaining the organization's methodology for bad debt estimation and the amount related to patients eligible for financial assistance.

- In Part V, enter detailed information about hospital facilities, including the community health needs assessment and financial assistance policy in place for each facility.

- Utilize Part VI to provide supplemental information about the organization’s evaluations of community health needs, patient education programs, and any affiliated health care systems.

- Review all sections to ensure accuracy and completeness before proceeding to save, download, or print the form.

Encourage completing your documents online for efficiency and accuracy.

Purpose of Schedule Hospital organizations use Schedule H (Form 990) to provide information on the activities and policies of, and community benefit provided by, its hospital facilities and other non-hospital health care facilities that it operated during the tax year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.