Loading

Get Irs 3903 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 3903 online

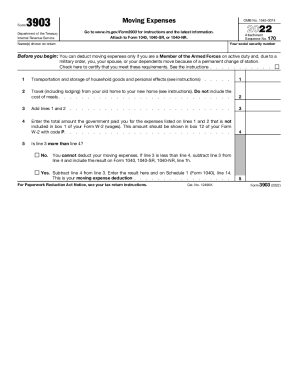

The IRS 3903 form allows eligible individuals to deduct moving expenses related to a military relocation. This guide provides a clear, step-by-step process for filling out the form online, ensuring a smooth and accurate submission.

Follow the steps to complete your IRS 3903 form effectively.

- Click ‘Get Form’ button to obtain the IRS 3903 form and open it in your preferred online editor.

- Fill in the name(s) as shown on your tax return.

- Before proceeding, ensure that you check the box to certify that you are a member of the Armed Forces on active duty and meet the requirements for moving expenses due to a permanent change of station.

- For line 2, record the total travel expenses from your old home to your new home, excluding meal costs. Clearly document expenses related to lodging.

- Add the amounts from lines 1 and 2 and enter the total on line 3.

- Make sure that this amount corresponds to box 12 of your Form W-2 with code P.

- Determine whether the amount on line 3 is greater than line 4. If it is not, you cannot deduct your moving expenses. If it is, you can subtract line 4 from line 3 and enter the result as your moving expense deduction on Schedule 1 (Form 1040), line 14.

- Finally, save changes to your completed form, and choose to download, print, or share it as needed.

Ready to complete your IRS 3903 form? Start filling it out online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Purpose of Form Use Form 3903 to figure your moving expense deduction if you are a member of the Armed Forces on active duty and, due to a military order, you move because of a permanent change of station.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.