Loading

Get Irs 8829 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8829 online

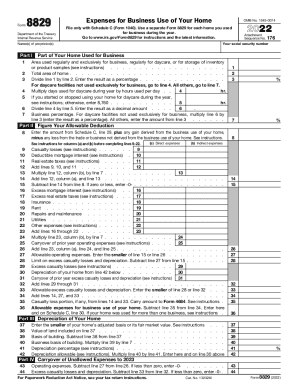

The IRS 8829 form is essential for individuals who use their home for business purposes. This guide will walk you through the detailed steps needed to fill out the form accurately online.

Follow the steps to complete the IRS 8829 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your social security number and the name(s) of proprietor(s) in the appropriate fields.

- In Part I, specify the area used regularly and exclusively for your business. Provide the total area of your home and calculate the percentage by dividing line 1 by line 2.

- For daycare facilities, complete line 4 by multiplying the number of days used for daycare during the year by the hours used each day. If applicable, enter 8,760 for the year.

- In Part II, enter the total amount from Schedule C, line 29, and any other relevant gains or losses in the designated fields.

- Complete the direct expenses and indirect expenses as listed, ensuring to check the instructions for guidance on each section.

- Once you've filled in all required sections, review your entries for accuracy.

- Finally, save your changes, download the form, print it, or share as necessary.

Complete your IRS 8829 form online to ensure accurate reporting for the business use of your home.

Form 8829 is only for taxpayers filing Form 1040 Schedule C. Sole proprietors and most single-member limited liability company (LLC) owners file Schedule C and are therefore eligible to calculate a home office deduction using Form 8829.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.