Loading

Get Nc Ncdva-9 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NCDVA-9 online

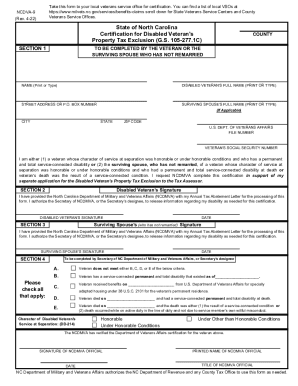

The NC NCDVA-9 form is essential for disabled veterans and their surviving spouses to apply for property tax relief in North Carolina. This guide provides detailed steps to help users navigate the process of completing the form online with ease.

Follow the steps to successfully complete the NC NCDVA-9 form online.

- Press the ‘Get Form’ button to access the NC NCDVA-9 form and open it in your preferred editor.

- Fill in Section 1 of the form, entering details such as your name, address, and the veteran's full name as applicable.

- If applicable, complete the surviving spouse's information in the same section. Ensure all entries are accurate and legible.

- In Section 2, the disabled veteran must provide their signature to authorize the release of disability information for certification.

- If you are the surviving spouse, complete Section 3 by signing and dating the form in the designated area.

- Submit the completed form to a local veterans service office for certification, where a Veterans Service Officer will fill out Section 4.

- Once certified, ensure that the completed NC NCDVA-9 form is submitted along with Form AV-9 to your local county tax office by the June 1 deadline.

- After filling out the form, save any changes, download the completed document, and prepare to print or share it as needed.

Complete your NC NCDVA-9 form online today to access the property tax relief benefits you deserve.

The disabled veteran homestead exemption is the first $45,000 of your assessed real property value. Co-owners who are not spouses and who are individually eligible for the benefit will receive the total exemption of $90,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.