Loading

Get Irs 433-b (oic) 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS 433-B (OIC) online

Filling out the IRS 433-B (OIC) form can be a crucial step in managing your business's tax debt effectively. This guide provides clear, step-by-step instructions on how to complete the form online while ensuring you include all necessary information.

Follow the steps to fill out the IRS 433-B (OIC) form online.

- Press the ‘Get Form’ button to access the IRS 433-B (OIC) form and open it in your preferred editor.

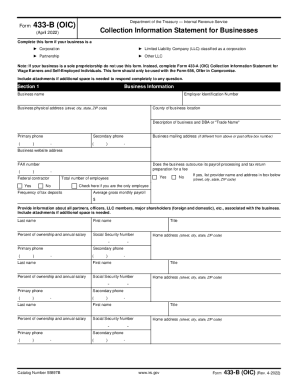

- In Section 1, provide your business information including the business name, Employer Identification Number, physical address, and contact information. Ensure that all entries are accurate and complete.

- Continue to Section 2, where you will detail your business assets. Gather necessary financial documents to enter current values for cash, accounts, and properties. Use resources like Kelley Blue Book for vehicle valuations.

- In Section 3, enter your business income by documenting average gross monthly income over the most recent 6-12 months. Include all sources of income to complete this section accurately.

- Fill out Section 4 with your business expenses, using the same 6-12 month documentation to determine average gross monthly expenses. List all recurring costs involved in running your business.

- Proceed to Section 5 to calculate your minimum offer amount based on remaining monthly income and available net assets. Ensure your calculated offer is more than zero.

- In Section 6, provide any additional information the IRS may require, such as bankruptcy status or prior litigation.

- Finally, complete Section 7 with the signature of the taxpayer, confirming that all information is accurate and complete. Ensure all necessary attachments are included.

- After filling out the form, save your changes and consider downloading or printing a copy for your records. You may then follow instructions for submitting the form to the IRS.

Complete your IRS 433-B (OIC) form online today to take the next step in managing your tax situation.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 433A- is a tax collection information statement for self-employed personnel and those that earn wages. IRS Form 433B- is a tax collection information statement for businesses. IRS Form 433F- is a generalized tax collection information statement.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.