Loading

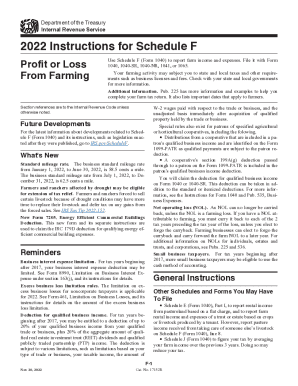

Get Irs 1040 Schedule F Instructions 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule F Instructions online

This guide provides comprehensive and supportive instructions for completing the IRS 1040 Schedule F, which is used to report farm income and expenses. Follow these steps to ensure accurate and efficient online filing.

Follow the steps to fill out the IRS 1040 Schedule F Instructions online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out your name and social security number at the top of the form. Ensure that the information is accurate to avoid any processing delays.

- On line D, enter the Employer Identification Number (EIN) issued to you, if applicable. If you do not have one, leave this line blank.

- In line B, select the appropriate principal agricultural activity code. Refer to Part IV on page 2 of Schedule F to choose the code that best describes your primary source of income.

- Under line C, indicate whether you use the cash or accrual method of accounting by checking the corresponding box.

- For Part I, report your farm income. Include items listed on lines 1 through 8, ensuring to sum up all cash received and fair market value of goods obtained.

- In Part II, document your farming expenses. Enter all relevant costs related to your farming operations, ensuring to categorize them correctly as outlined in the instructions.

- For Part III, if using the accrual method, perform similar reporting by including income when earned and listing any corresponding expenses.

- Review all entries for accuracy before submission, ensuring that each section reflects your farming activities correctly.

- Once completed, save your changes. You can download, print, or share the form directly from the editor.

Complete your IRS 1040 Schedule F Instructions online to file your farm income and expenses efficiently.

Schedule F is used to report taxable income earned from farming or agricultural activities. This schedule must be included on Form 1040 tax return, regardless of the type of farm income. Schedule F also allows for various farm-related credits and deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.