Loading

Get Mt Dor Dcac 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR DCAC online

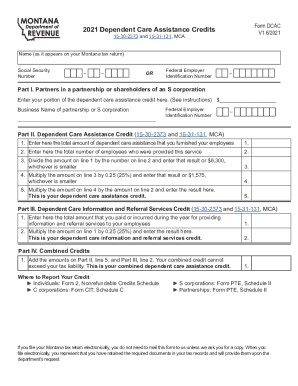

This guide provides step-by-step instructions for successfully completing the MT DoR DCAC form online. Whether you are an employer seeking to claim dependent care assistance credits or a partner in a partnership, this information will support your filing process.

Follow the steps to complete your MT DoR DCAC form correctly.

- Press the ‘Get Form’ button to obtain the MT DoR DCAC and open it in your preferred editor.

- Fill in your name as it appears on your Montana tax return in the designated field.

- Enter your Social Security number or Federal Employer Identification Number in the appropriate fields.

- Complete Part I if you are a partner in a partnership or a shareholder of an S corporation. Enter your portion of the dependent care assistance credit, the business name, and the business's Federal Employer Identification Number.

- In Part II, input the total amount of dependent care assistance you provided to your employees in line 1. Next, enter the total number of employees who received this assistance in line 2.

- For line 3, divide the amount from line 1 by the number from line 2 and enter that result or $6,300, whichever is smaller.

- Multiply the amount on line 3 by 0.25 (25%) and enter the result or $1,575, whichever is smaller in line 4.

- On line 5, multiply the amount on line 4 by the number of employees from line 2 and enter the result, which is your dependent care assistance credit.

- In Part III, indicate the total amount you paid for dependent care information and referral services in line 1. Multiply this amount by 0.25 and enter the result in line 2; this will be your dependent care information and referral services credit.

- In Part IV, add the amounts from Part II, line 5, and Part III, line 2. This combined credit cannot exceed your tax liability.

- If you complete the form electronically, you do not need to mail it unless requested. Review all information for accuracy, save your changes, and download or print the form to retain a copy for your records.

Begin completing your MT DoR DCAC online form today to ensure a smooth filing process.

For Montanans who turned 62 or older in 2021, the Elderly Homeowner/Renter Tax Credit can bring up to $1,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.