Loading

Get Mt Dor Est-i 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT DoR EST-I online

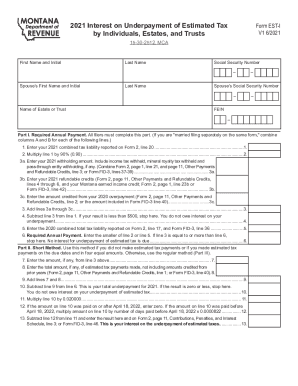

The MT DoR EST-I form is used to calculate any interest due on underpayments of estimated tax for individuals, estates, and trusts in Montana. This guide will provide clear instructions on how to complete the form online, ensuring an accurate submission.

Follow the steps to complete the MT DoR EST-I form online

- Press the 'Get Form' button to access the MT DoR EST-I form and open it in your desired editor.

- Begin by entering your first name and initial, your last name, and your Social Security number in the designated fields.

- If applicable, fill in your spouse's first name, initial, last name, and Social Security number, or the name of your estate or trust along with its FEIN.

- Complete Part I by entering your 2021 combined tax liability reported on Form 2, line 20, on line 1, and multiply this amount by 90% and record it on line 2.

- Input the various amounts from lines 3a, 3b, and 3c to calculate the total payments made and subtract this total from your tax liability on line 4.

- Follow through to line 6 to determine the required annual payment by entering the smaller amount from lines 2 or 5.

- Move to Part II if you qualify for the short method or continue to Part III if you made payments of unequal amounts.

- Fill out lines 14 through 24 in Part III for the regular method, entering your required quarterly payments and the amounts you paid for each quarter in the corresponding columns.

- Calculate the interest on underpayments by completing lines 25 through 28 in Part III, determining the number of days late and your resulting interest.

- If using the annualized method, complete Part IV before returning to Part III, and calculate your adjustments and interest as necessary.

- Review all entries for accuracy and confirm that all calculations reflect your financial information correctly.

- Finally, you can save your changes, download, print, or share the completed form as required.

Complete your MT DoR EST-I form online today for a smooth tax handling experience.

The Internet EIN application is the preferred method for customers to apply for and obtain an EIN. Once the application is completed, the information is validated during the online session, and an EIN is issued immediately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.