Loading

Get Mt Gen Reg 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Gen Reg online

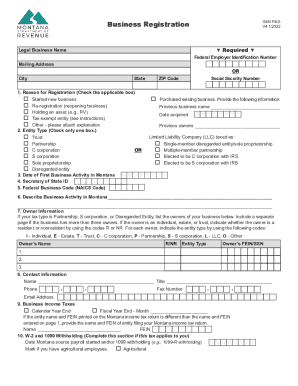

Filling out the MT Gen Reg form is essential for registering your business in Montana. This guide provides a step-by-step approach to accurately complete the form online, ensuring you have all necessary information ready for submission.

Follow the steps to successfully fill out the MT Gen Reg.

- Press ‘Get Form’ button to access the MT Gen Reg document and open it for editing.

- Enter your Federal Employer Identification Number and Legal Business Name in the required fields. Include the mailing address, city, state, and ZIP code.

- Select the reason for registration by checking the appropriate box. Options include starting a new business, purchasing an existing business, re-registering, or holding an asset.

- Indicate the entity type by checking one box from the options provided such as LLC, corporation, or sole proprietorship.

- Provide the date of first business activity in Montana using the MM/DD/YYYY format.

- Input your Secretary of State ID, if applicable, as outlined in the form.

- Enter your Federal Business Code, also known as the NAICS Code, in the designated area.

- Complete the business activity description section to provide detailed information about your operations in Montana.

- List the owner information, indicating whether each owner is a resident or non-resident, and include their FEIN or SSN.

- Fill out the contact information section with the name and phone number of a contact person for any inquiries regarding the form.

- Choose whether your business income taxes follow a calendar year or a fiscal year and complete the relevant section.

- If applicable, fill in the sections related to W-2 and 1099 withholding, as well as any mineral royalty withholding.

- Select any applicable miscellaneous taxes for your business and provide any required additional information for each location.

- Complete the business equipment tax section, if necessary, and answer related questions.

- Sign and date the declaration section, ensuring the document is signed by the appropriate individual such as an authorized representative.

- After reviewing all information for accuracy, save the changes, and decide whether to download, print, or share the completed form.

Complete your MT Gen Reg form online today and ensure your business is registered in Montana.

A disregarded entity is a business entity that is disregarded for federal income tax purposes. Instead, income from the business is included on its owner's income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.