Loading

Get Ks Ar 50 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS AR 50 online

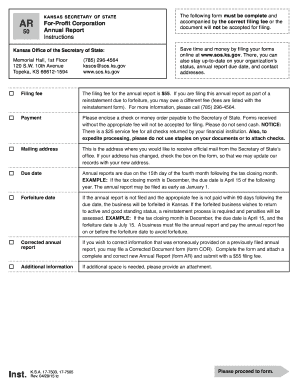

Filling out the KS AR 50 annual report online is an important process for for-profit corporations in Kansas. This guide will provide detailed instructions on how to complete each section of the form efficiently and accurately.

Follow the steps to complete your annual report online.

- Press the ‘Get Form’ button to access the KS AR 50 form and open it in your online editor.

- Enter your business entity ID number, ensuring it is distinct from the Federal Employer ID Number.

- Input the name of your corporation exactly as it appears on record with the Kansas Secretary of State.

- Provide your mailing address where official mail will be sent from the Secretary of State’s office.

- Fill in the principal office address, using a street address instead of a P.O. box.

- Specify your tax closing date by entering the month and year.

- List the name, title, and address of each officer within the corporation, ensuring no fields are left blank.

- Indicate the name and address of each director of the corporation, providing additional details if necessary.

- Enter your Federal Employer Identification Number.

- Describe the nature and kind of business your corporation engages in.

- Indicate the total number of shares of capital stock issued by your corporation.

- Answer whether your corporation holds more than 50% equity ownership in any other business entity and provide details if applicable.

- State if your corporation owns or leases land in Kansas suitable for agriculture, based on specific criteria.

- Declare accuracy under penalty of perjury by providing the signature of an authorized officer, including name, title, and phone number.

- Review the completed form for any missed information before saving changes, downloading, printing, or sharing the form.

Complete your KS AR 50 form online today and ensure your corporation remains in good standing.

Failing to file an annual report for your LLC in Kansas can lead to serious consequences. Your company may face penalties, including fines or a potential loss of good standing with the state. To avoid these issues and stay aligned with KS AR 50 guidelines, it is crucial to file on time. Make your life easier by utilizing the tools from uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.