Loading

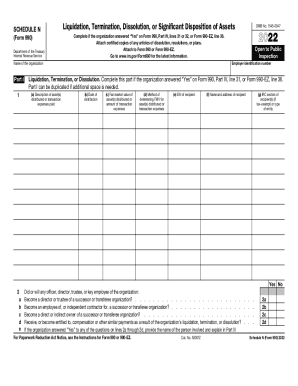

Get 2022 Schedule N (form 990). Liquidation, Termination, Dissolution, Or Significant Disposition Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2022 Schedule N (Form 990). Liquidation, Termination, Dissolution, Or Significant Disposition Of online

This guide provides comprehensive instructions for completing the 2022 Schedule N (Form 990), which is essential for organizations undergoing liquidation, termination, dissolution, or a significant disposition of assets. It aims to assist users in understanding the form's components and necessary steps to ensure proper filing.

Follow the steps to complete Schedule N accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin with Part I, which details the organization’s liquidation, termination, or dissolution. Report the assets transferred, including their descriptions and fair market values.

- Enter the date of distribution for each listed asset in the appropriate section.

- Provide the method used to determine the fair market value for each asset and transaction expense.

- For each recipient of distributed assets, fill in the Employer Identification Number (EIN), name, and address. Avoid using social security numbers.

- Address the follow-up questions regarding the involvement of any officers, directors, or key employees in successor organizations. Answer accordingly and provide necessary details in Part III.

- If applicable, complete Part II for any significant disposition of more than 25% of the organization’s assets. Follow the same reporting structure as in Part I.

- Use Part III for any supplemental information required by previous sections, ensuring clarity and completeness.

- Review the completed form thoroughly. Save changes, download, print, or share the form as necessary to finalize the filing.

Start completing your Schedule N online today to ensure compliance and accountability.

A 501(c)(3) organization must file for dissolution first with its state and then send the approved dissolution documentation to the IRS. It is important for an organization to check with its state Attorney General's office first to ensure that the specific procedures and documentation are submitted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.