Loading

Get Irs 1120-h 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-H online

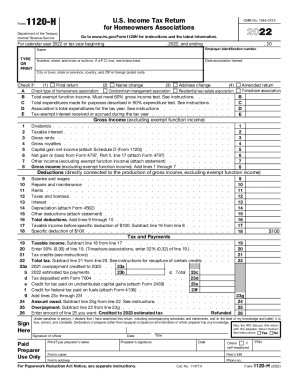

This guide provides a clear and comprehensive overview of the IRS 1120-H, which is the U.S. income tax return for homeowners associations. Whether you are a new user or have previous experience, this step-by-step guide will assist you in completing the form accurately and efficiently online.

Follow the steps to successfully complete the IRS 1120-H form.

- Click the ‘Get Form’ button to access the IRS 1120-H form and open it in your chosen editor.

- Enter the basic information, including the name of the homeowners association, employer identification number, and address details. Ensure that the name and identifying information are correct to avoid processing delays.

- Indicate the type of homeowners association by selecting the appropriate checkbox, and fill in the date the association was formed. This step is crucial for tax classification.

- Complete sections B through E, where you will need to input total exempt function income, total expenditures for the 90% expenditure test, and other relevant financial information pertaining to the association.

- Report gross income excluding exempt function income. Fill in the amounts for dividends, taxable interest, gross rents, and other applicable sources of income. Ensure that all figures are accurately summed in the final field.

- List the deductions that are directly connected to the production of gross income. This includes salaries, repairs, maintenance, and other deductible expenses. Make sure to total up these deductions correctly.

- Calculate and record your taxable income by making the necessary subtractions based on the gross income and deductions entered earlier. This will determine your tax liability.

- Proceed to complete the tax and payments section. Enter the calculated tax amount and any payments made, including credits from the previous year or estimated tax payments.

- Sign and date the form where indicated, ensuring compliance with perjury declarations. This confirms the accuracy of the submitted information.

- Once all sections are completed and verified, save your changes. You can download, print, or share the form as needed for your records.

Complete your IRS 1120-H form online today for a smooth filing experience.

Tax rate. The taxable income of a homeowners association that files its tax return on Form 1120-H is taxed at a flat rate of 30% for condominium management associations and residential real estate associations. The tax rate for timeshare associations is 32%. These rates apply to both ordinary income and capital gains.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.