Loading

Get Irs 8283 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8283 online

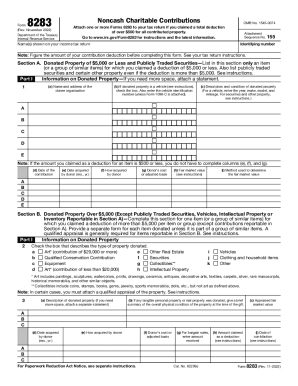

The IRS 8283 form is essential for claiming noncash charitable contributions for tax deductions. This guide provides straightforward, step-by-step instructions to assist you in completing the form online.

Follow the steps to successfully complete the IRS 8283 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your identifying number and the name(s) shown on your income tax return at the top of the form.

- In Section A, list any donated property valued at $5,000 or less, including publicly traded securities. Include all necessary details such as the name and address of the donee organization, description of the property, and fair market value.

- If applicable, indicate if the donated property is a vehicle by checking the box and providing the vehicle identification number.

- In Section B, for donated property over $5,000, complete the relevant parts as instructed, detailing the type of property and providing a description along with the appraised fair market value.

- Ensure you check and fill out any required appraisals or summaries of the physical condition of the property.

- In Part II, if you gave less than an entire interest in a property, complete the required lines to report this information.

- For the taxpayer statement, declare any items identified as being valued at $500 or less.

- Complete the declaration of the appraiser as necessary, including their signature, date, and details.

- Finally, review all entries for accuracy before saving your changes to the form. You can then download, print, or share the completed form as needed.

Complete your IRS 8283 form online today to ensure your charitable contributions are accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you are claiming a deduction of more than $500,000 for an item (or group of similar items) donated to one or more donees, you must attach the qualified appraisal of the property to your Form 8283 unless an exception applies.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.