Loading

Get Mo Form E-1r 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-1R online

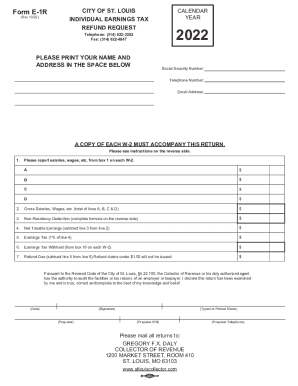

The MO Form E-1R is designed for individuals seeking a refund of the individual earnings tax based on wages earned outside the City of St. Louis. This guide will provide you with a clear, step-by-step process to help you accurately complete the form online.

Follow the steps to complete the MO Form E-1R effectively.

- Press the ‘Get Form’ button to access the MO Form E-1R and open it in your preferred online editor.

- In the designated space, clearly input your name and address. Make sure to enter your social security number, telephone number, and email address as well.

- Attach a copy of each W-2 form to your refund request. Ensure that all W-2s are included to avoid any processing delays.

- On lines A, B, C, and D, report your total gross salaries, wages, or other earnings as indicated in box 1 of each W-2. Input these figures accordingly.

- Calculate the total of lines A, B, C, and D and enter this amount on box 2 as your gross salaries, wages, etc.

- Complete the non-residency deduction formula found on the reverse side of the form and enter this result on line 3.

- For line 4, subtract the non-residency deduction from the total gross salaries reported on line 2.

- On line 5, enter 1% of the net taxable earnings calculated on line 4.

- On line 6, enter the total earnings tax withheld as shown on box 19 of each W-2.

- Finally, subtract the earnings tax from line 5 from the earnings tax withheld on line 6 to calculate the refund due. Enter this amount on line 7.

- Once all fields are complete and accurate, save your changes, download the form for your records, and/or print it for submission.

Start filling out your MO Form E-1R online today to claim your earnings tax refund.

Form MO-60 is due on or before the due date of the return. A copy of Form MO-60 must be enclosed with the Missouri return when filed. An approved Form MO-60 extends the due date up to six months for the individual income tax returns, and five months for fiduciary, and partnership income tax returns.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.