Loading

Get Irs 945 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 945 online

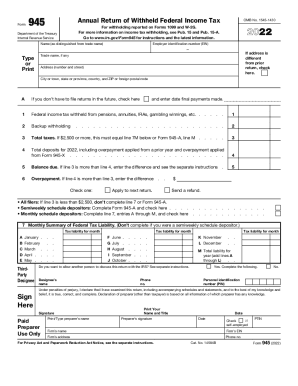

Filling out the IRS Form 945 is an essential task for those required to report withheld federal income tax. This guide provides a clear, step-by-step approach to completing the form online, ensuring that users can navigate the process confidently and accurately.

Follow the steps to successfully complete your IRS 945 online.

- Click ‘Get Form’ button to access the IRS Form 945 and open it in your preferred editor.

- Begin by entering your name as it differs from your trade name in the designated field, followed by your employer identification number (EIN). If your address has changed since your last return, be sure to check the appropriate box.

- Fill in your complete address, including street number, city or town, state or province, country, and ZIP or foreign postal code.

- Indicate whether you do not need to file returns in the future by checking the appropriate box.

- Proceed to report the federal income tax withheld from various sources such as pensions and gambling winnings in line 1.

- Record any backup withholding in line 2.

- Calculate and enter the total taxes for the year in line 3. Ensure that this figure matches the requirements if it is $2,500 or more.

- Input the total deposits made for the year in line 4.

- Determine if you owe any balance due by comparing line 3 and line 4, entering the difference in line 5 if applicable.

- If you have overpaid, indicate this in line 6 and enter the date final payments were made.

- Complete the Monthly Summary of Federal Tax Liability section, filling out the tax liabilities for each month from January to December.

- Decide if you want a designee to discuss this return with the IRS, and if so, provide the designee's name and personal identification number (PIN).

- Sign the form, including your title and the date.

- If you have a paid preparer, include their details and signature in the space provided.

- Review all entered information for accuracy before proceeding to save changes, download, print, or share the form as needed.

Complete your IRS Form 945 online today to ensure compliance and timely submission.

Sections 3402, 3405, and 3406 of the Internal Revenue Code require taxpayers to pay over to the IRS federal income tax withheld from certain nonpayroll payments and distributions, including backup withholding. Form 945 is used to report these withholdings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.