Loading

Get Irs 886-h-hoh 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 886-H-HOH online

Filling out the IRS 886-H-HOH form can be essential to establish your Head of Household filing status. This guide provides clear steps tailored to your needs to help you complete this form online effectively.

Follow the steps to fill out the IRS 886-H-HOH form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Fill in the name of the taxpayer in the designated field. Ensure your name is spelled correctly to avoid any issues with processing.

- Provide the taxpayer identification number, which helps the IRS associate the form with your tax records.

- Indicate the tax period ending. Ensure this reflects the correct year for which you are filing.

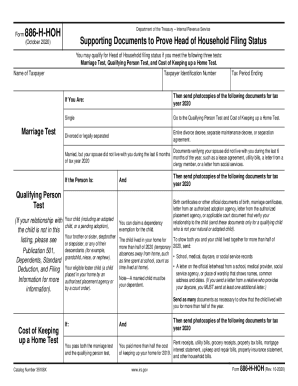

- Review the Marriage Test section. Depending on your marital status (single, divorced, or separated), follow the instructions to gather supporting documents and indicate your status accordingly.

- Complete the Qualifying Person Test section. Identify the qualifying child or relative you are claiming and ensure to attach the required documents, such as birth certificates or custody agreements.

- Navigate to the Cost of Keeping up a Home Test section. Detail your eligibility by providing photocopies of the necessary documents that show you paid more than half the cost of maintaining your household.

- After filling out all necessary sections, review the form for any errors or omissions. Double-check your contact information and attached documents for accuracy.

- Save your changes, and then you can download, print, or share the completed form as required.

Start completing your IRS 886-H-HOH form online today to ensure you maximize your tax benefits.

Explanation of Items (Form 886-A) - This section is where the IRS will explain the changes they have made. The IRS may also provide you with detailed information which explains their reasoning for these changes, such as a set of IRS instructions or information from a publication.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.