Loading

Get Mo Dor 4923 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 4923 online

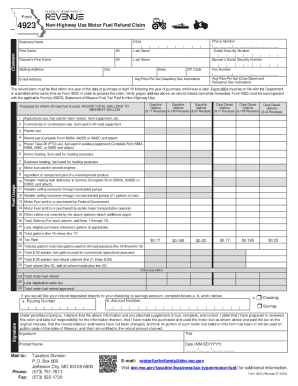

The MO DoR 4923 is a crucial document for individuals and businesses seeking a refund for motor fuel taxes paid on non-highway fuel usage. This guide provides clear and comprehensive instructions on how to complete the form online, ensuring that users can confidently navigate through each section.

Follow the steps to complete the MO DoR 4923 online.

- Click ‘Get Form’ button to access the MO DoR 4923 and open it in your preferred online editor.

- Enter your basic information. Fill in your last name, first name, and mailing address. Ensure that your contact details, including your phone number and email address, are accurate.

- Indicate your FEIN and social security number. If applicable, enter your spouse's information as well.

- Provide the average price per gallon for the fuel types used. You can derive this figure from your receipts and ensure that it accurately reflects all transactions.

- Detail your fuel usage by entering the total gallons for each category listed (e.g., agricultural use, commercial use). Be sure to round to the nearest gallon.

- Calculate the total gallons used and the total tax paid. These amounts should reflect the sums from your categorized entries.

- Review the total refund amount calculated at the bottom of the form, ensuring all entries are correct.

- Complete the banking information if you opt for a direct deposit. Fill in the routing number and account number.

- Sign and date the form to affirm that all information is true and complete. Note that unsigned forms will be returned.

- Save your changes, then download, print, or share the completed form as needed for submission.

Start filling out the MO DoR 4923 online today to ensure you receive your motor fuel tax refund.

Refund claims for Missouri motor fuel tax paid on fuel purchased for non-highway use must continue to be filed using Non-Highway Use Motor Fuel Refund Claim (Form 4923).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.