Loading

Get Irs 1120-reit 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120-REIT online

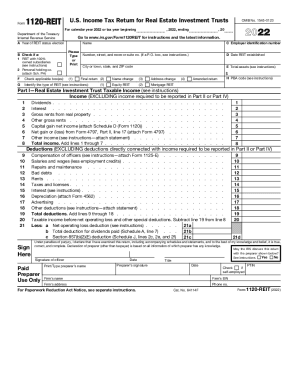

Completing the IRS 1120-REIT form online is essential for real estate investment trusts to fulfill their tax obligations. This guide provides a detailed, step-by-step approach to help users effectively navigate the form and ensure accurate submission.

Follow the steps to successfully complete your IRS 1120-REIT form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the necessary information in Section A, including the name and Employer Identification Number (EIN) of the REIT, along with the address and date of establishment.

- In Section B, check the applicable box for REIT status, indicating if you have 100% owned subsidiaries or if you are a personal holding company.

- Proceed to Part I for reporting real estate investment trust taxable income. Fill out fields for dividends, interest, gross rents, capital gain net income, and other relevant income (lines 1-8).

- Complete the deductions section (lines 9-21), indicating compensation of officers, salaries, repairs, taxes, and other expenses.

- Calculate and report your taxable income, noting any net operating loss deductions and deductions for dividends paid.

- Continue to Part II, where you will handle tax on net income from foreclosure property, entering total gross income and deductions related to foreclosure property.

- Move to Part III to address any tax for failure to meet source-of-income requirements. Summarize and calculate total income, then determine taxes due.

- In Part IV, if applicable, report on tax related to net income from prohibited transactions.

- Complete the deduction for dividends paid on Schedule A, adding all applicable categories of dividends and calculating total deductions.

- Fill out Schedule J to compute taxes, considering any relevant credits or deductions outlined in the instructions.

- Finally, ensure all fields are filled accurately, review the information for correctness, and then save changes, download, print, or share your completed form.

Start filling out your IRS 1120-REIT form online to ensure compliance and timely submission.

A U.S. REIT must be formed in one of the 50 states or the District of Columbia as an entity taxable for federal purposes as a corporation. It must be governed by directors or trustees and its shares must be transferable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.