Loading

Get Mo Dor Mo-2210 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR MO-2210 online

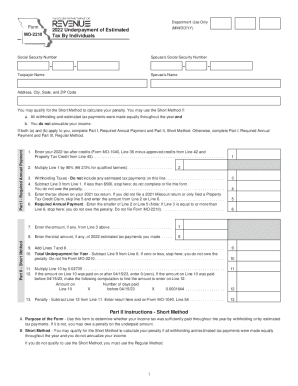

Filling out the MO DoR MO-2210 form online is essential for determining whether you owe a penalty for underpayment of estimated tax. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the MO-2210 form online.

- Click the ‘Get Form’ button to access the online version of the MO DoR MO-2210 and open it in your preferred editor.

- Begin filling in your personal details. This includes entering your Social Security Number and your partner's Social Security Number, if applicable.

- Enter your name and your partner's name, ensuring all information is accurately spelled.

- Provide your complete address, including city, state, and ZIP code.

- Determine if you qualify for the Short Method to calculate your penalty by checking the two conditions listed. If both are met, continue to Part I.

- Complete Part I by calculating your Required Annual Payment. Start by entering your 2022 tax after credits in the first line.

- Follow the instructions to multiply the first line by 90% or the applicable percentage for qualified farmers.

- Continue with the calculations provided in the subsequent lines, making sure to subtract where indicated and consider any underpayments.

- If you qualify for the Short Method, complete Part II. Alternatively, proceed to Part III if you need to use the Regular Method.

- For each section, carefully input your figures based on the guidelines provided, meticulously checking your work for accuracy.

- Once you have filled out all relevant sections, review the entire form for errors or omissions.

- After confirming all information is correct, save your changes, and consider downloading, printing, or sharing the completed form as needed.

Get started now and complete your MO DoR MO-2210 online to ensure compliance and avoid any penalties.

Related links form

Regardless of where your income was earned or if you are using Form MO-CR or Form MO-NRI, you must begin the Missouri return with your federal adjusted gross income, as reported on your federal return. Next, apply all allowable deductions and compute the tax on all of your income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.