Loading

Get Irs W-4(sp) 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-4(SP) online

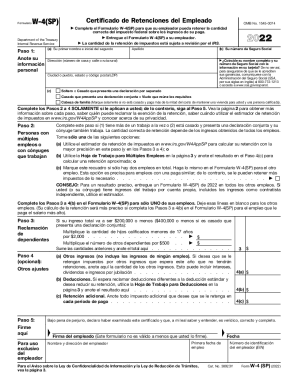

Filling out the IRS W-4(SP) form is essential for ensuring the correct amount of federal income tax is withheld from your paycheck. This guide offers clear instructions to help you complete the form online efficiently.

Follow the steps to accurately complete the IRS W-4(SP) online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your personal information, including your first name, middle initial, last name, and Social Security number. Ensure that this information matches your Social Security card to avoid issues with earnings being credited correctly.

- Provide your address, including house number, street name, city, state, and ZIP code.

- Select your filing status by indicating whether you are single, married filing separately, married filing jointly, or head of household.

- Complete Steps 2 through 4 only if they apply to you; otherwise, proceed to Step 5.

- If applicable, complete Step 2 if you have multiple jobs or your spouse works. You can use the tax withholding estimator for accuracy.

- In Step 3, claim dependents if you qualify, and calculate any applicable credits.

- Step 4 is optional for additional adjustments, including other income, deductions, and extra withholding amounts.

- Under penalty of perjury, sign and date the form at Step 5, ensuring accuracy and completeness.

- Finally, submit the completed Form W-4(SP) to your employer. You can save changes, download, print, or share this form depending on your requirements.

Ensure your tax withholding is accurate by completing your IRS W-4(SP) online today.

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.