Loading

Get Wi Dor W-700 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR W-700 online

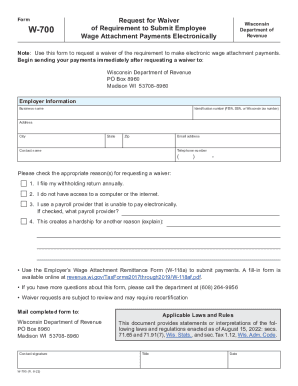

The WI DoR W-700 form is a request for a waiver of the requirement to submit employee wage attachment payments electronically. This guide will provide comprehensive instructions for completing the form online, ensuring that you can navigate each section with confidence.

Follow the steps to complete the WI DoR W-700 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your employer information. Fill in your business name, identification number (which can be your FEIN, SSN, or Wisconsin tax number), and your business address, including city, state, and zip code.

- Next, provide your email address, contact name, and telephone number. Ensure that all contact details are accurate for potential follow-up communication.

- Indicate the appropriate reason(s) for requesting a waiver by checking the relevant options. You may select one or multiple reasons provided on the form.

- If you are using a payroll provider that cannot pay electronically, please specify the name of that payroll provider in the space provided.

- In the final section, if you have selected 'this creates a hardship for another reason,' please explain your circumstances in the available text field.

- After completing all the sections of the form, review your entries for accuracy and completeness. Adjust any information as needed.

- Once you have confirmed that all information is correct, you can proceed to save your changes. You may choose to download, print, or share the completed form as required.

Submit your WI DoR W-700 form online to ensure compliance with the waiver request requirements.

Updated federal W-4 Colorado* (employees can use either the federal W-4 or Colorado's state W-4 form) Delaware* (employees can use either the federal W-4 or Delaware's state W-4 form) Idaho. Minnesota. Montana. Nebraska. South Carolina.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.