Loading

Get Irs 1040 - Schedule Lep 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule LEP online

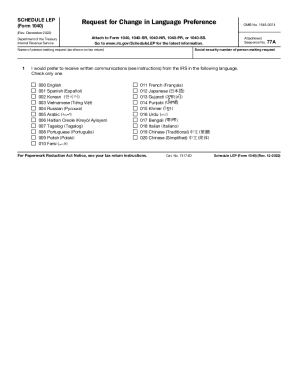

The IRS 1040 - Schedule LEP is a useful form for individuals who prefer to receive written communications from the IRS in a language other than English. This guide will walk you through the process of completing this form online, ensuring that you can effectively communicate your language preference to the IRS.

Follow the steps to complete the IRS 1040 - Schedule LEP online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Enter the social security number of the person making the request in the designated field. Make sure this matches the number listed on your tax return.

- In the language preference section, check only one box to indicate your preferred language for future written communications. This only applies to the listed options.

- If you are filing jointly and both you and your partner prefer a language other than English, ensure to submit a separate form for each of you.

- After completing the form, save the changes, and you can then download or print the completed Schedule LEP for your records.

- Attach Schedule LEP to your Form 1040, 1040-SR, 1040-NR, 1040-PR, or 1040-SS before filing your tax return.

Complete your Schedule LEP online to ensure you receive IRS communications in your preferred language.

The IRS is committed to providing taxpayers with limited English proficiency meaningful access to information regarding their taxpayer rights and responsibilities. Use Schedule LEP to request written communications from the IRS in an alternative language.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.