Loading

Get Ct Drs Ct-706 Nt 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-706 NT online

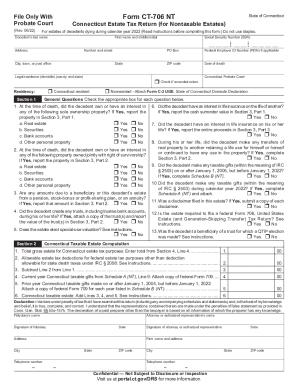

The CT DRS CT-706 NT form is a crucial document for filing Connecticut estate taxes for nontaxable estates. This guide will provide a detailed, step-by-step approach to help you fill out this form online with accuracy and ease.

Follow the steps to complete the CT DRS CT-706 NT form online.

- Press the ‘Get Form’ button to access the CT DRS CT-706 NT form online and open it for editing.

- Begin by entering the decedent's personal information, including their last name, first name, middle initial, address, and Social Security Number (SSN). Make sure to provide the date of death and indicate the decedent's legal residence.

- In Section 1, specify the residency status — check the appropriate box to indicate if the decedent was a Connecticut resident or a nonresident. If a nonresident, remember to attach Form C-3 UGE.

- Answer the general questions related to the property owned by the decedent at the time of death. Carefully check 'Yes' or 'No' for each question regarding sole ownership, joint ownership, pensions, trusts, and any taxable gifts.

- Proceed to Section 3 to report the property and proceeds for Connecticut estate tax purposes. This includes listing solely owned property, jointly owned property, and life insurance proceeds.

- Complete Section 4 by totaling the gross estate value as calculated from Section 3. Be sure to add all relevant lines correctly.

- If applicable, fill out Sections 5 and 6 for probate fee calculations based on property located inside or outside of Connecticut.

- Complete any necessary schedules, such as Schedule A (NT) for current year Connecticut taxable gifts and Schedule B (NT) for gifts from prior periods.

- Finally, review the entire form for accuracy, then save your changes, download, or print the completed form for submission.

Complete your CT DRS CT-706 NT form online to ensure timely and accurate filing.

Who Can File Form 706? Form 706 must be filed by the executor of the estate of every U.S. citizen or resident: Whose gross estate, adjusted taxable gifts, and specific exemptions total more than the exclusion amount: $12.06 million for decedents who died in 2022 ($12.92 million in 2023), or34.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.