Loading

Get Il Dor Boa-1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR BOA-1 online

Filling out the IL DoR BOA-1 form requires careful attention to detail. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently, whether you are doing it for yourself or on behalf of a business or loved one.

Follow the steps to successfully complete the IL DoR BOA-1 form.

- Click the ‘Get Form’ button to access the IL DoR BOA-1 form and open it in the online editor.

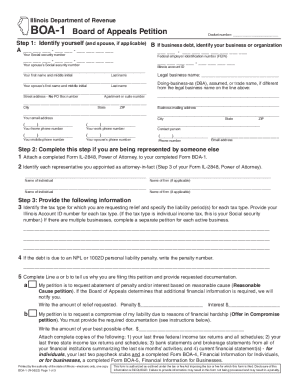

- Begin by identifying yourself, and if applicable, your spouse. If your request is related to business debt, ensure to identify your business or organization as well. Fill in your Social Security number and the Federal Employer Identification Number (FEIN) where prompted.

- Provide all necessary contact and identifying information. This includes your first and last name, Illinois account ID, legal business name, and various phone numbers. Ensure accuracy in the street address and include your email address for further communications.

- If you are represented by someone else, attach a completed Form IL-2848, Power of Attorney, to your BOA-1 form. Identify each representative you have appointed as attorney-in-fact by providing their names and firms if applicable.

- Specify the tax type for which you are requesting relief and detail the relevant liability periods. Include your Illinois Account ID number for each tax type. Remember that if the tax type is individual income tax, provide your Social Security number.

- If the debt is related to a personal liability penalty, enter the penalty number. Also, complete either Line a or b, indicating whether your petition requests abatement of penalties based on reasonable cause or a compromise due to financial hardship. Provide the necessary documentation as stated in the instructions.

- Confirm whether all your tax returns have been filed by selecting Yes or No. If No, provide a brief explanation.

- Indicate if you are requesting a temporary restraining order (TRO). Explain your reasoning as to why the petition is appropriate and should be decided in your favor, providing any necessary additional information.

- For business-related petitions, specify the start date of your business activity in Illinois. If your business activity has ceased, also provide the date it was discontinued.

- Decide if you are requesting a hearing at the Board of Appeals. Check the appropriate box and specify how you would prefer the hearing to be conducted.

- Sign the form in the designated areas. If the petition includes joint debt, ensure both parties sign. Confirm that the information provided is true, correct, and complete.

- Finally, review the completed form for any errors, save your changes, and proceed to download, print, or share the form as required.

Complete your IL DoR BOA-1 form online today to ensure timely processing of your petition.

Illinois has a flat 4.95 percent individual income tax rate. Illinois also has a 9.50 percent corporate income tax rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.