Loading

Get Ct Drs Ct-706 Nt Ext 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS CT-706 NT EXT online

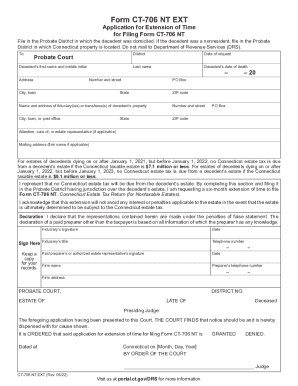

Filling out the CT DRS CT-706 NT EXT form is an important step for those seeking an extension for filing the Connecticut Estate Tax Return (Form CT-706 NT). This guide will walk you through the process of completing the form online in a clear and supportive manner.

Follow the steps to effectively complete the CT DRS CT-706 NT EXT form.

- Press the 'Get Form' button to obtain the CT-706 NT EXT form and open it in the online editor.

- Indicate the Probate District where the application is to be submitted. This depends on the decedent's domicile or the location of Connecticut property if the decedent was a nonresident.

- Enter the decedent's first name, middle initial, and last name in the respective fields.

- Provide the full address of the decedent, including the number and street, city or town, state, and ZIP code.

- Fill in the name and address of the fiduciary or transferee responsible for the decedent's property. If there is no fiduciary, the individual in possession or control of the property should complete this section.

- If necessary, provide additional mailing information for the fiduciary.

- Sign the form in the designated signature area, indicating your title if you are the fiduciary.

- Submit the completed form to the appropriate Probate Court by the specified due date for the Form CT-706 NT. Keep a copy for your records.

Start completing your CT DRS CT-706 NT EXT form online today for a smoother filing experience.

Related links form

Form CT-706/709 EXT only extends the time to file your Connecticut estate and gift tax return; it does not extend the time to pay your gift tax. This extension request is due on or before the original due date for filing Form CT-706/709.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.