Loading

Get Wi I-010i 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

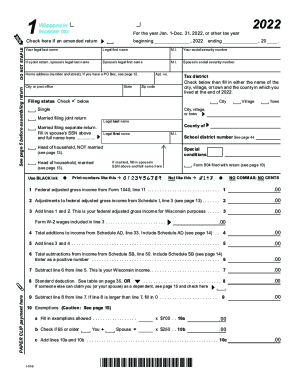

How to fill out the WI I-010i online

Filling out the WI I-010i form online is essential for submitting your income tax return accurately. This guide provides a step-by-step approach to ensure that you understand each section of the form, allowing for a smooth filing process.

Follow the steps to complete the WI I-010i form online.

- Click the 'Get Form' button to access the WI I-010i and open it for online editing.

- Begin by entering your personal information in the designated fields. Provide your legal first name, middle initial, and social security number. If filing jointly, include your spouse's name and information in the respective fields.

- Indicate your filing status by selecting the appropriate checkbox. Options include single, married filing jointly, married filing separately, head of household, and more.

- Fill in the address section, including your city or post office, state, zip code, and any apartment number if applicable.

- Enter your federal adjusted gross income, along with any adjustments, on the corresponding lines. Be careful to follow the format guidelines — avoid using commas and cents.

- Complete the additions and subtractions to income as directed. Ensure that you include any necessary schedules as outlined in the form.

- Calculate your taxable income by following the instructions on the lines outlined, ensuring to check for any credits or deductions that may apply.

- Review all information entered to ensure accuracy. If everything is correct, you can save your changes and choose to download, print, or share the completed form as needed.

Start filling out your WI I-010i form online today to ensure timely and accurate submission of your tax return.

The Tax Foundation notes that Wisconsin's 7.65% tax rate is third highest in the Midwest, behind Minnesota and Iowa; and it's the third highest among all Great Lakes states. Only New York and Minnesota are higher on that list. Among our neighbors, both Illinois and Michigan have lower income tax rates than Wisconsin.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.