Loading

Get Ct Drs-ewvr 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT DRS-EWVR online

Filling out the CT DRS-EWVR form online can be an efficient way to request a waiver for electronic filing and payment requirements. This guide provides clear, step-by-step instructions to help users navigate each section of the form with ease.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the form and open it in the editor.

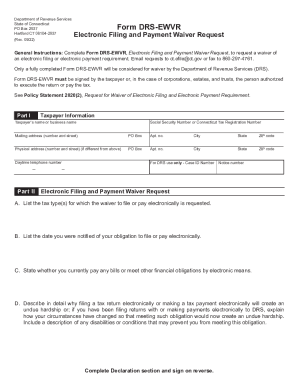

- In Part I, provide your taxpayer information. Enter your name or business name, followed by your Social Security Number or Connecticut Tax Registration Number. Fill in your mailing address, including any PO Box or apartment number, city, state, and ZIP code. If your physical address differs from your mailing address, include that information as well.

- Record your daytime telephone number in the specified field. This will assist the Department of Revenue Services in reaching you if needed.

- Move to Part II. Here, list the tax types for which you are requesting a waiver to file or pay electronically. It is essential to be as detailed as possible.

- Indicate the date you were notified about the obligation to file or pay electronically. This helps establish the timeline of your circumstances.

- Answer whether you currently meet any financial obligations electronically. This information can influence the DRS’s decision on your waiver request.

- In the detailed description section, explain why electronically filing or paying taxes presents an undue hardship for you. If you had been filing electronically in the past, detail how your circumstances have changed. Include any relevant disabilities or conditions affecting your ability to fulfill these electronic obligations.

- Once all sections are complete, fill out the Declaration section on the reverse side. Sign the form, print your name, date it, and include your title if applicable.

- After completing the form, save your changes and prepare to submit it. You can download, print, or share the completed form as needed.

Start completing your CT DRS-EWVR form online today!

You must begin withholding at the highest marginal rate of 6.99%, from each employee who claimed exempt status from Connecticut income tax withholding in the prior year and who did not provide a new Form CT-W4 on or before February 15 of the current year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.