Loading

Get Mo Mo-ptc Chart 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-PTC Chart online

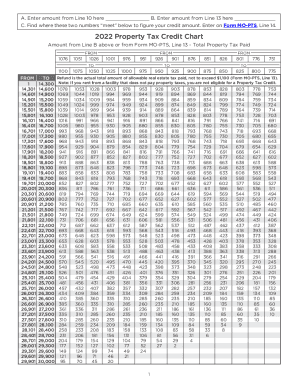

Filling out the MO MO-PTC Chart is an essential step for individuals seeking a property tax credit in Missouri. This guide provides clear and comprehensive instructions on how to complete the form effectively, ensuring you understand each section and field.

Follow the steps to successfully complete the MO MO-PTC Chart online.

- Press the ‘Get Form’ button to access the MO MO-PTC Chart and open it for completion.

- In the designated section A, input the amount from Line 10. This is the initial value needed to determine your credit.

- Next, in section B, enter the amount from Line 13. This figure represents the total property tax or 20 percent of rent paid.

- Locate the area where the two amounts from sections A and B intersect. This intersection will guide you in determining your credit amount.

- Once you have identified the credit amount, ensure to enter this information on Form MO-PTS, specifically on Line 14.

- After completing all sections and fields accurately, be sure to save your changes. You can also choose to download, print, or share the completed form as needed.

Start filling out your MO MO-PTC Chart online today to secure your property tax credit.

To claim real estate taxes for a prior year, you must file a claim for that year. Example: If you paid your 2021 real estate tax in calendar year 2022, you must file a 2021 Property Tax Credit Claim (Form MO-PTC).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.