Loading

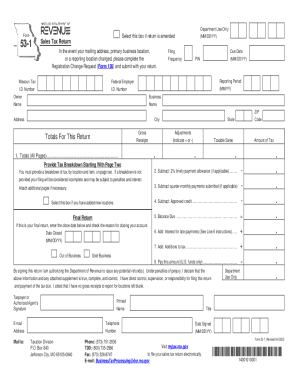

Get Mo Dor Form 53-1 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR Form 53-1 online

Filling out the MO DoR Form 53-1 online is a crucial task for individuals and businesses required to report sales tax in Missouri. This guide will provide you with clear and detailed instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the MO DoR Form 53-1

- Select the ‘Get Form’ button to access the MO DoR Form 53-1 and open it in your preferred digital editor.

- Begin by entering your Missouri Tax I.D. Number, which is an eight-digit number assigned to your business.

- Input the Federal Employer I.D. Number, a nine-digit identification number issued by the IRS.

- Specify the filing frequency, which indicates how often you are required to file returns, and include the due date for the return.

- Fill in the reporting period using the appropriate format (MM/YY) relevant to your filing frequency.

- Provide the owner's name, business name, mailing address, city, state, and ZIP code.

- For line 1, aggregate totals from all pages, including gross receipts, adjustments, taxable sales, and tax due.

- Complete page two as needed, ensuring to break down each location's tax, including item codes, gross receipts, and tax calculations.

- If applicable, check any boxes for adding new locations or indicating this is a final return.

- Perform all necessary calculations, including subtracting timely payment allowances, previous payments, and any approved credits to determine the balance due.

- Finally, review all entries for accuracy, then save changes, and follow the steps to download, print, or share the completed form.

Start filling out your MO DoR Form 53-1 online today to ensure timely and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Complete a new Form W-4, Employee's Withholding Allowance Certificate, and submit it to your employer. Complete a new Form W-4P, Withholding Certificate for Pension or Annuity Payments, and submit it to your payer. Make an additional or estimated tax payment to the IRS before the end of the year.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.