Loading

Get Mo Mo-941 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-941 online

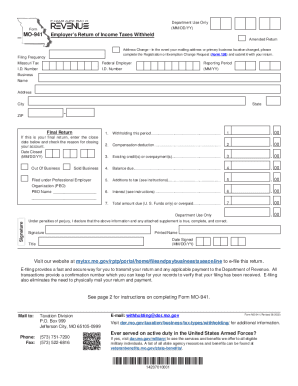

This guide provides detailed instructions on completing the MO MO-941, the employer's return of income taxes withheld, online. Filling out this form correctly is essential to ensure compliance with Missouri tax regulations.

Follow the steps to effectively complete the MO MO-941 online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Enter your Missouri Tax I.D. Number, which is an eight-digit number issued by the Missouri Department of Revenue to identify your business.

- Provide your Federal Employer I.D. Number, a nine-digit identification number assigned by the Internal Revenue Service.

- Fill in the Reporting Period information specifying the tax period you are filing for, based on your filing frequency.

- Input your Business Name, Address, City, State, and ZIP code as they appear on your business documentation.

- On Line 1, enter the total amount of state withholding tax withheld for the reporting period. If none was withheld, enter zero.

- On Line 2, state the amount retained for timely payments as part of the Compensation Deduction.

- On Line 3, indicate the amount of any Existing Credits or Overpayments applicable towards this reporting period.

- Calculate the Balance Due by subtracting Line 2 and Line 3 from Line 1, and enter this on Line 4.

- On Line 5, enter any Additions to Tax necessary based on your situation, using the relevant percentages.

- Calculate interest for Line 6 by applying the daily interest rate to the amount due for every day late, if applicable.

- Finally, complete Line 7 with the Total Amount Due or Overpaid by adding Lines 4, 5, and 6.

- Review all filled sections for accuracy and completeness. Once satisfied, you can save your changes, download, print, or share the form.

Complete your MO MO-941 online today for a fast and secure filing experience.

Most businesses are required to file Form 941 quarterly, with a few exceptions. Seasonal businesses only need to file for the quarters in which they are operating. Businesses that hire farm workers or household employees, such as a maid, also don't need to file Form 941 (but do need to file Schedule H from Form 1040).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.