Loading

Get Ca Boe-65 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA BOE-65 online

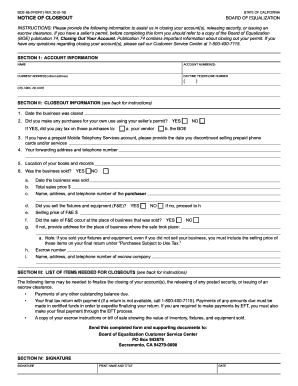

The CA BOE-65 form, also known as the Notice of Closeout, is essential for users closing their business accounts with the California Board of Equalization. This guide will provide you with clear, step-by-step instructions to fill out the form online effectively.

Follow the steps to complete the CA BOE-65 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In Section I, begin by entering your account information. Include your name, account number(s), current address, and a daytime telephone number.

- Move to Section II to provide closeout information. First, indicate the date your business was closed. Answer whether you made purchases for personal use with your seller’s permit and specify if tax was paid to your vendor or the Board of Equalization.

- If applicable, enter the date you stopped selling any prepaid mobile telephony services. Additionally, provide your forwarding address and telephone number.

- Specify the location of your books and records, as this is vital for audit purposes. Indicate whether the business was sold, and if so, provide the sale date, total sales price, and the purchaser's contact information.

- Answer additional questions regarding the sale of fixtures and equipment, including their selling price and whether the sale occurred at the business's location.

- Move to Section III to review the list of items needed for closeouts. Ensure you have payments of any outstanding balances, your final tax return with payment, and a copy of the escrow instructions or bill of sale.

- After completing all relevant sections, proceed to Section IV. Sign and print your name and title, then date the form.

- Finally, submit the completed form along with supporting documents to the Board of Equalization Customer Service Center at the provided address.

Complete your CA BOE-65 form online today for a smooth account closeout process.

BOE 19 P is a form utilized for the California Board of Equalization's property tax appraisal process. It is designed for property owners to disclose changes or updates regarding their property. If you are navigating the CA BOE-65 landscape, understanding BOE 19 P becomes crucial in maintaining accurate tax records and assessments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.