Loading

Get Az L015 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ L015 online

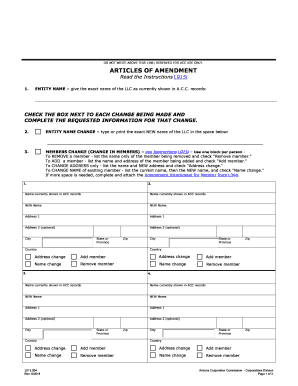

Filling out the AZ L015 form online is an essential step for making amendments to your LLC registration in Arizona. This guide provides a clear, step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the AZ L015 form with ease.

- Use the ‘Get Form’ button to access the AZ L015 form online and open it in your browser.

- Enter the exact name of the LLC as currently recorded in Arizona Corporation Commission (A.C.C.) records in the designated section.

- If you are changing the LLC name, type or print the new name in the space provided.

- For changes in members, use one block per person. Indicate if you are adding, removing, or changing the name or address of a member by checking the appropriate box and provide the required information.

- Repeat the process for any managers, using a separate block for each and checking the corresponding options for adding, removing, or changing details.

- Indicate any changes regarding the management structure by selecting the type of management (manager-managed or member-managed) and ensure to attach the relevant structure form.

- If you are appointing a new statutory agent, provide their name and physical address in Arizona. Make sure to also submit the Statutory Agent Acceptance form M002 with your amendment.

- Update the known place of business address if necessary, indicating whether it is the same as the statutory agent's address.

- Check the new duration for your LLC, indicating if it is perpetual or if there is a specific end date.

- If changing entity types or making other amendments not covered by existing sections, provide the details as required.

- Acknowledge acceptance of the document and sign it, including your printed name and date. Ensure you select the correct option regarding your capacity to sign.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed AZ L015 form as needed.

Start completing your AZ L015 form online today to efficiently manage your LLC amendments.

Yes, if your corporation earns income in Arizona, you are required to file a corporate tax return. This is crucial for compliance with Arizona tax laws. The AZ L015 feature offers great insights into your tax obligations, making the process more manageable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.