Loading

Get Tn Rv-f1306901 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1306901 online

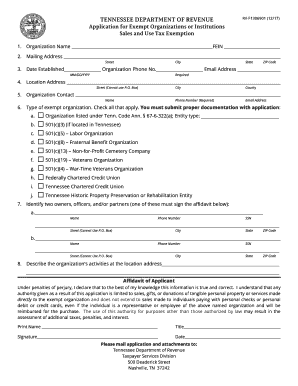

This guide provides a comprehensive step-by-step approach to completing the TN RV-F1306901 form, which is the application for exempt organizations or institutions sales and use tax exemption in Tennessee. By following these instructions, users can efficiently fill out the form online with confidence.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the TN RV-F1306901 application form and open it in your chosen editor.

- In the first section, enter the organization name in the provided field. Ensure that the information matches the official documents of the organization.

- Next, fill in the mailing address. Include the street address, city, state, and ZIP code. Provide an organization phone number and email address where required.

- Indicate the date established using the format MM/DD/YYYY.

- For the location address, input the street address, city, county, and include a phone number. Note that a P.O. Box cannot be used.

- Identify an organization contact with their name and details as requested in the form.

- Choose the appropriate type of exempt organization by checking all applicable boxes. If needed, submit the correct documentation that corroborates the entity’s exemption.

- Provide details for two owners, officers, or partners by filling out their names, phone numbers, and Social Security Numbers. This section requires no P.O. Box for the address.

- Describe the organization’s activities at the specified location. This may include a brief overview of operations or services provided.

- Complete the affidavit section by signing and dating where indicated. Ensure the printed name and title are included as well.

- Upon completing the form, you may save changes, download a copy, or print the form for submission via mail to the Tennessee Department of Revenue.

Complete the TN RV-F1306901 form online today to ensure your organization benefits from sales and use tax exemptions.

Registration of sales tax is available on the Tennessee Taxpayer Access Point (TNTAP). To apply, please go to Tennessee Taxpayer Access Point (TNTAP) and select Register a New Business. For more guidance on sales and use tax account registration, please read this article.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.