Loading

Get Ri Ri-9465 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI RI-9465 online

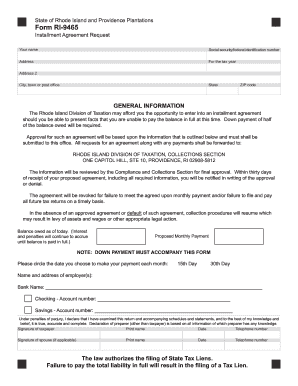

The RI RI-9465 is the Installment Agreement Request form for tax payments in the state of Rhode Island. This guide will provide you with clear, step-by-step instructions to navigate the online completion of this form efficiently.

Follow the steps to fill out the RI RI-9465 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field along with your social security or federal identification number.

- Fill in your complete address, including street, city, state, and ZIP code. If there is an additional address line, provide that information as well.

- Indicate the tax year for which you are requesting the installment agreement.

- In the general information section, review the details about the installment agreement, including required down payments and the submission process.

- Specify the balance owed as of today. Note that interest and penalties will continue to apply until the balance is paid in full.

- Propose a monthly payment amount that you believe you can manage.

- Select a payment date by circling either the 15th or the 30th of each month.

- Provide the name and address of your employer(s) next, and list your bank name, including checking and savings account numbers.

- Review the declaration section and verify all information is accurate before signing. Signature is required from both taxpayer and spouse (if applicable).

- Complete the income and expense statement, detailing monthly net income and expenses. Include all sources of income and list types of expenses.

- Fill out the balance sheet by detailing your assets and liabilities. This will help provide a comprehensive overview of your financial situation.

- Once all fields are complete, review your entries for accuracy. You may then save changes, download, print, or share the completed form.

Complete your RI RI-9465 form online today to manage your tax obligations effectively.

The total penalties and interest can easily add up to 9% to 12% per year, and taxpayers must be prepared to pay this amount in addition to their principal balance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.