Loading

Get Pa Rev-1832 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA REV-1832 online

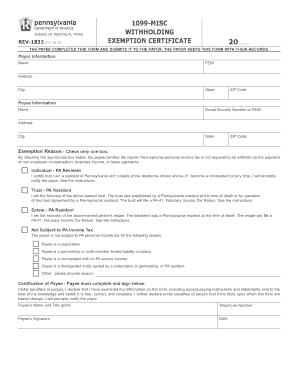

The PA REV-1832, known as the 1099-MISC withholding exemption certificate, is an essential document for determining whether Pennsylvania personal income tax withholding is required on certain payments. This guide will walk you through the process of filling out the form online, ensuring that you provide the necessary information accurately and efficiently.

Follow the steps to complete the PA REV-1832 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the payor information in the designated fields. You will need to include the payor's name, federal employer identification number (FEIN), address, city, state, and ZIP code.

- Fill in the payee information, including your name, Social Security number or FEIN, address, city, state, and ZIP code. If you are a disregarded entity, ensure to use the home address of the single owner.

- Select one exemption reason by checking only one box that applies to your situation. This may include options for individuals, trusts, estates, or stating that you are not subject to Pennsylvania income tax.

- Complete the certification of payee section. Here, you must print your name, title (if applicable), and telephone number. Then, sign and date the form.

- Once all information has been entered accurately, you can save changes, download, print, or share the form as needed.

Complete your PA REV-1832 online to ensure proper handling of your tax exemptions today.

Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.