Loading

Get Ny It-196 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY IT-196 online

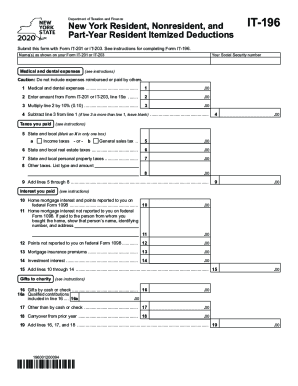

The NY IT-196 form is designed for New York residents, nonresidents, and part-year residents to report their itemized deductions. Completing this form accurately is crucial for ensuring that you receive the appropriate deductions on your tax returns.

Follow the steps to accurately complete the NY IT-196 online.

- Press the ‘Get Form’ button to access the document and open it in the editor.

- Begin by filling in your name(s) as shown on your Form IT-201 or IT-203 in the designated field.

- Enter your Social Security number in the appropriate section to ensure your identity is verified.

- Proceed to report your medical and dental expenses on line 1. Be cautious to exclude any expenses that were reimbursed or paid by another party.

- On line 2, enter the amount from Form IT-201 or IT-203, line 19a, to calculate the applicable deduction.

- On line 3, multiply the amount on line 2 by 10% (0.10) for your calculation.

- Next, provide the relevant amounts for taxes you paid, starting with state and local options on lines 5 through 8. Mark the box that applies.

- Fill out the interest you paid, including home mortgage interest as reported on federal Form 1098 as well as any other relevant expenses in lines 10 to 14.

- Report your charitable contributions starting on line 16. Include cash donations on line 16 and other contributions on line 17, followed by any carryover from the previous year on line 18.

- Continue with miscellaneous deductions, documenting job expenses and any other allowable deductions as specified in sections 21 through 39.

- Finally, once all information has been filled out and reviewed, you can save changes to the form, then download, print, or share it as needed.

Complete your form accurately and conveniently online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Complete Form IT-196 to compute your New York State itemized deduction. ... If you itemize, you can deduct a part of your medical and dental expenses, unreimbursed employee business expenses, and amounts you paid for certain taxes, interest, contributions, and miscellaneous expenses.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.