Loading

Get Mn Dor M8 Instructions 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR M8 Instructions online

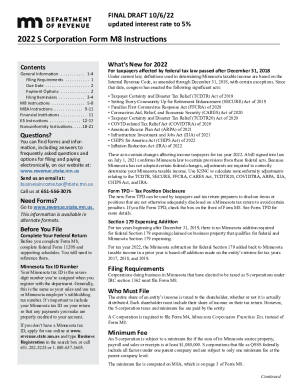

Navigating the MN DoR M8 Instructions can seem daunting, but this guide provides a clear, step-by-step approach to ensure you accurately complete the form online. Following these instructions will help you complete your filing efficiently and correctly.

Follow the steps to successfully complete the MN DoR M8 Instructions online.

- Click the 'Get Form' button to obtain the MN DoR M8 Instructions and open it in your editor.

- Begin by ensuring you have completed your federal Form 1120S and any supporting schedules, as you will need to reference them while filling out the M8 Instructions.

- Enter your Minnesota tax ID number, which is the seven-digit number assigned to you when you registered with the department. This number is crucial for crediting any payments correctly.

- Review the filing requirements section carefully to determine if your S corporation is required to file the M8. Ensure that your business qualifies based on the thresholds outlined.

- Check the relevant boxes on the front of the form, indicating if this is your initial return, if you are electing composite income tax, and if you have a qualified subchapter S subsidiary.

- Fill in the income, deductions, credits, and taxes for the S corporation, referring to your completed federal return. Be diligent in rounding amounts accurately to whole dollars.

- For lines regarding pass-through entity (PTE) tax or composite income tax, ensure you complete the appropriate schedules and attach them to your submission.

- Complete all additional lines as instructed, including any adjustments related to nonconformity for residents and nonresidents.

- Double-check that all required schedules and forms, such as Schedule KS for shareholders, are enclosed before finalizing your submission.

- Once the form is fully completed, save your changes, and print out or download a copy of the MN DoR M8 Instructions for your records.

- Submit the completed form electronically or by mailing it to the specified address if filing by paper.

Start filling out your MN DoR M8 Instructions online today to ensure compliance and efficiency in your tax filing!

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.