Loading

Get Sc Dor Sc4506 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC DoR SC4506 online

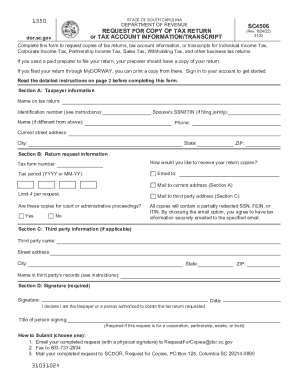

The SC DoR SC4506 form allows users to request copies of tax returns or tax account information. This guide provides clear instructions to help users fill out the form accurately when completing it online.

Follow the steps to fill out the SC DoR SC4506 online.

- Click ‘Get Form’ button to obtain the SC4506 form online and open it in your preferred editor.

- In Section A, provide the taxpayer information. Enter the name on the tax return and the identification number, which may be an SSN, ITIN, FEIN, or other specified numbers. If filing jointly, include the spouse's SSN/ITIN. Complete the current address and phone number.

- Move to Section B, Return request information. Indicate how you wish to receive the copies by selecting either email or mail. Specify the tax form number, which can be found at the top right of your tax return, and the corresponding tax period formatted as MM-YY or YYYY. Mark if the copies are for court or administrative use.

- Proceed to Section C if applicable, entering the third party information. Provide the name of the third party along with their address and additional name details if they differ from those in Section A.

- Complete Section D by signing the form. Ensure your signature matches what is on the tax return. Remember, a physical signature is mandatory for processing the request.

- Finally, submit the completed SC4506 form through your chosen method: email it to RequestForCopies@dor.sc.gov with your signature, fax it to 803-737-2934, or mail it to SCDOR, Request for Copies, PO Box 125, Columbia, SC 29214-0890.

Fill out the SC DoR SC4506 online today for your tax return information!

Below are the requirements for each.... Having worked and earned lower income to $59,187. Have had investment income of less than $10,300 in tax year 2022. Have a valid Social Security number. Be a US citizen or resident alien for the entire year. Failing to File Form 2555 (Foreign Earned Income)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.