Loading

Get Mi 151 2021-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 151 online

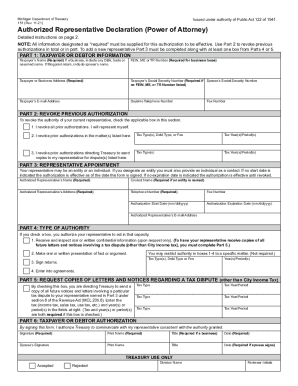

Filling out the MI 151 form provides authorization for the Michigan Department of Treasury to communicate on your behalf. This guide offers clear, step-by-step instructions to help you navigate the completion of this online form with ease.

Follow the steps to successfully complete the MI 151 online.

- Click the ‘Get Form’ button to acquire the MI 151 form and open it in your online editor.

- Fill out Part 1 with the taxpayer or debtor information. This includes the taxpayer’s name, FEIN, ME or TR number (if applicable), taxpayer or business address, and any required social security numbers. Ensure you provide an email address and daytime telephone number for further communication.

- If you need to revoke previous authorizations, proceed to Part 2 and check the appropriate boxes. Specify if you are revoking all prior authorizations or if it is specific to certain tax types or periods.

- In Part 3, designate a representative by filling in their name, address, and contact information. Indicate whether it is an individual or an entity. If applicable, ensure to provide a contact name if an entity is chosen.

- Complete Part 4 to specify the type of authority you grant to your representative. Check the relevant boxes to allow them to receive confidential information, make presentations, sign returns, or enter into agreements.

- In Part 5, request copies of letters and notices regarding any tax disputes. Fill out the required tax types and years or periods associated with these disputes, if applicable.

- Finalize the form in Part 6 by signing and dating the document. If applicable, provide your spouse’s signature and details as well.

- Once all sections are completed, you can save changes, download your form, or print it for submission. Ensure all required information is filled out to avoid invalidation.

Complete your MI 151 form online today and ensure effective communication with the Michigan Department of Treasury.

Every employer is required to withhold who: 1) has a location in the city, or 2) who is doing business in the city even though the employer has no location in the city.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.