Loading

Get Wi Dor Schedule Wd 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI DoR Schedule WD online

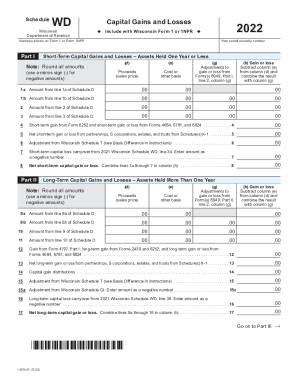

Completing the WI DoR Schedule WD is an essential step for individuals reporting their capital gains and losses for Wisconsin taxes. This guide provides clear and supportive instructions to help users fill out the form accurately online, catering to all levels of experience.

Follow the steps to successfully complete your WI DoR Schedule WD online.

- Click ‘Get Form’ button to access the Schedule WD and open it in the editor.

- Begin by entering the name(s) shown on Form 1 or Form 1NPR at the top of the form.

- In the section for your social security number, input the number accurately.

- Part I focuses on short-term capital gains and losses. Fill in the proceeds (sales price) and cost or other basis for each asset held for one year or less. Ensure all amounts are rounded and use a minus sign (-) for negative values.

- Calculate the adjustments to gain or loss from Forms 8949, Part I. Provide the total gain or loss in column (h) by subtracting column (e) from column (d) and adding column (g) to it.

- Continue this process for all required lines in Part I, ensuring accuracy in your calculations.

- For Part II, follow a similar approach for assets held longer than one year, entering the relevant data and calculating the net long-term gain or loss.

- Proceed to Part III to summarize your totals from Parts I and II. Follow the specific instructions to fill out lines 18 to 28 accurately, deciding on losses where necessary.

- Complete Part IV with the necessary adjustments to income as indicated. Ensure to follow instructions carefully for each line.

- In Part V, if applicable, calculate and fill in the capital loss carryovers from 2022 to 2023 as required.

- Final steps include saving your changes, and options for downloading, printing, or sharing the completed form.

Complete your WI DoR Schedule WD online today!

Related links form

The U.S. taxes income at progressively higher rates as you earn more. Those rates—ranging from 10% to 37%—will remain the same in 2023. What's changing is the amount of income that gets taxed at each rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.